Daily compound interest accounts

For example interest-bearing checking accounts savings accounts and CDs or share certificates at credit unions all commonly use compound interest when calculating how much they owe you. Compound Daily Interest Calculator.

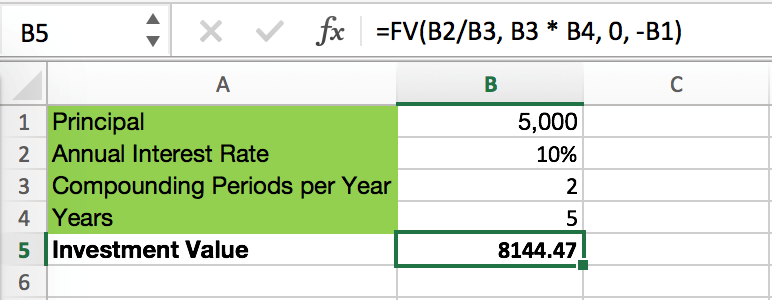

Compound Interest Formula And Financial Calculator Excel Template

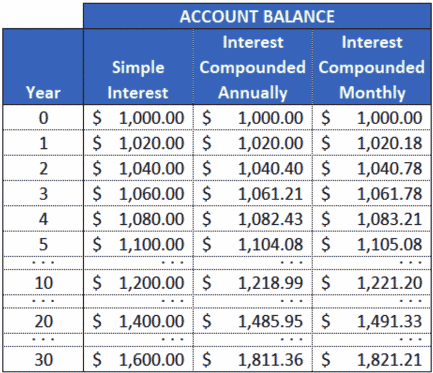

This contrasts with non-compounding interest that only considers the initial balance when being calculated.

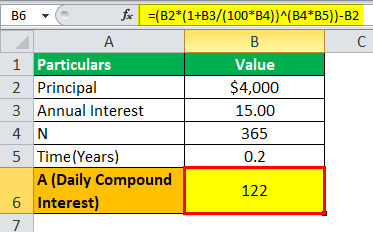

. The APY on the account would be. Daily compound interest which you have earned 64860. High interest savings accounts offer more competitive interest rates to help your savings grow.

Some common types of accounts that pay compound interest include savings accounts money market accounts and certificates of deposit CDs. P is the principal balance of financial instruments which can be certificates of deposit bonds savings accounts and many others. With simple interest the balance on that bond would have been 23250 on the maturity date.

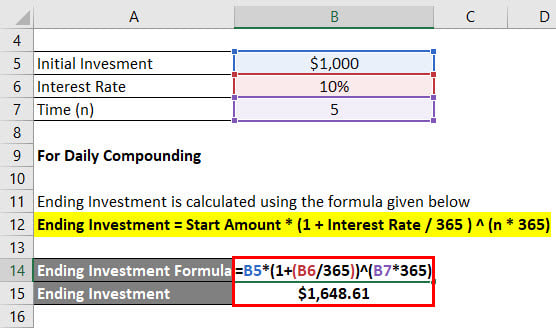

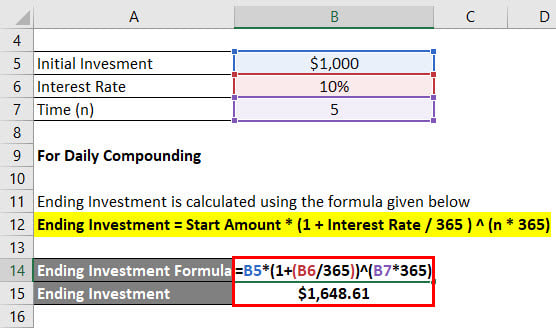

Ending Investment is calculated using the formula given below. For example say you have 100 in a savings account and it earns interest at a 10 rate compounded annually. Compound interest is the addition of interest to the principal sum of a loan or deposit or in other words interest on principal plus interest.

Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. High Interest Savings Accounts Comparison. Ending Investment Start Amount 1 Interest Rate n.

If a bank offers a 100 interest rate on a savings account the rate of compounding could affect the APY and your earnings although the differences may be minor. Open your free account. You can find many of these calculators online.

A t 365 2 A t. Some accounts only calculate interest monthly or annually. While the interest rates are still somewhat low they are also extremely safe investments for your money.

You can find accounts that compound monthly or even daily to maximize your returns. For example if you invest 100 and earn 1 annually compounding daily youd earn 00274 daily 1 365 in interest. 1 200365 365 1 202 APY.

Compound interest is the interest added to the original amount invested and then you earn interest on the new amount which grows larger with each interest payment. For example if interest compounds daily during the course of the year the interest that is added after the first day then earns additional interest for the rest of the year. While most of these are savings accounts or money market accounts there.

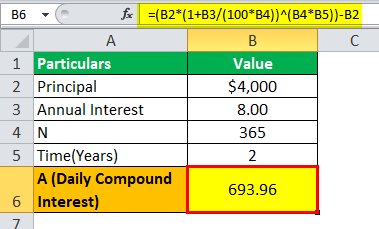

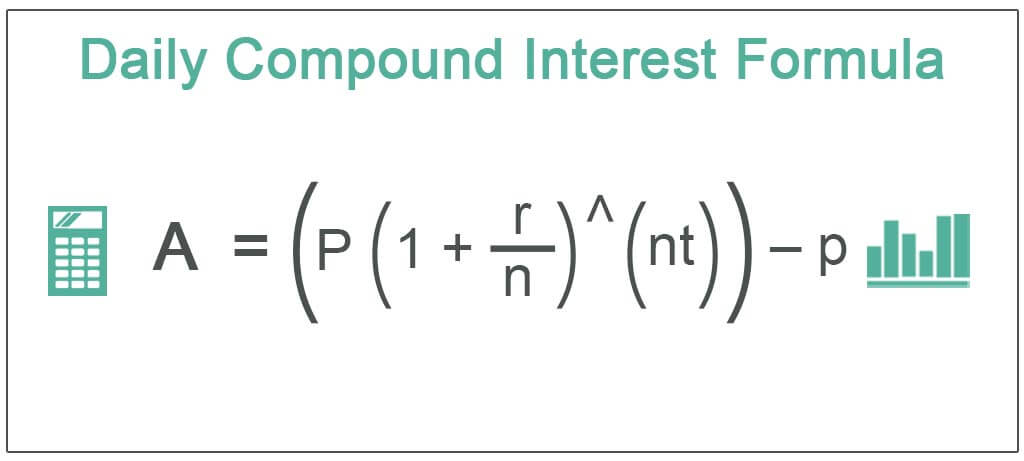

At the end of the first year youd have 110 100 in principal 10 in interest. P1 RNNT A. P is the investment or principal balance at the start of.

Bankrates compound interest. Investors can especially benefit from the power of. Comparing the APY rather than the interest rate of two accounts will show which truly pays more interest.

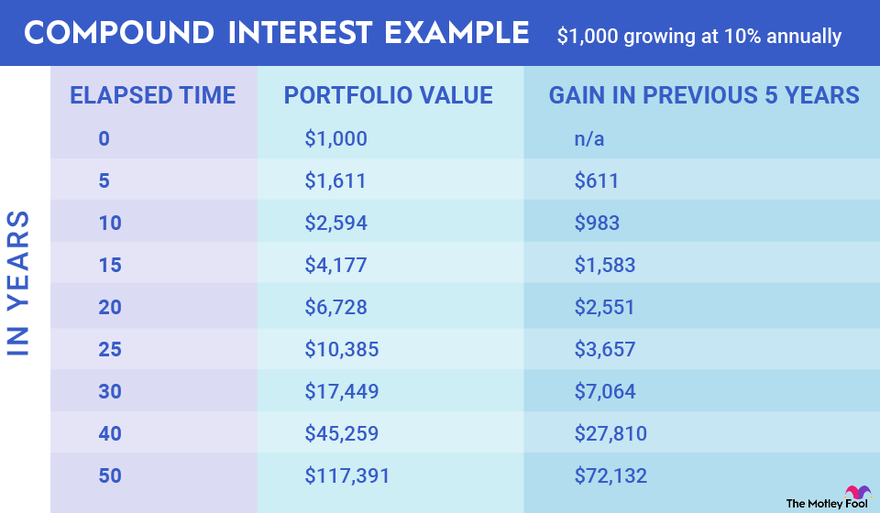

The Principle of Compound Interest. More frequent compounding periodsdaily for examplehave more dramatic results. Thought to have.

With a compound interest account you earn compound interest at set intervals. All high interest-earning savings accounts have variable rates meaning they could go up or down over time usually in response to changes to the Reserve Bank cash rate. The n variable is the frequency of interest paid in a time period and t is the number of time periods.

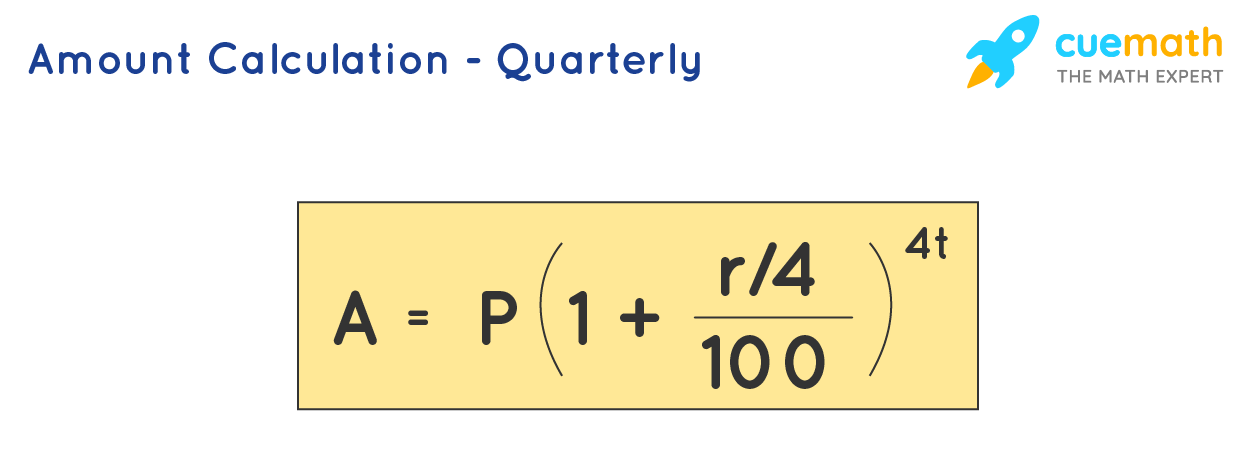

Your savings account interest could compound daily monthly quarterly or annually. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. Compound interest on the other hand accounts for the additional interest that is generated by interest added to your account throughout the year.

It is the result of reinvesting interest or adding it to the loaned capital rather than paying it out or requiring payment from borrower so that interest in the next period is then earned on the principal sum plus previously accumulated interest. Daily Compound Interest 64861. Interest paid in year 1 would be 60 1000 multiplied by 6 60.

In the world of personal finance interest is an amount paid over a previously established amount and it is invariably expressed as a percentage that we call interest. Compound interest is when you earn interest calculated based on the deposit as well as the past interest. You might only see interest payments added to your account monthly but calculations can still be done daily.

Compound Daily Interest Calculator. My favorite high interest savings account is by CIT Bank. When opening a savings account look for accounts that compound daily.

There are some accounts that generate compound interest daily. Assume that you own a 1000 6 savings bond issued by the US Treasury. Understand how compound interest works and take a look at compound interest accounts on offer in Australia.

Daily closing balance x interest rate as a percentage 365. Using the formula above depositors can apply that daily interest rate to calculate the following total account value after two years. Lets go over the compound interest formula and define each of the variables.

Calculate interest compounding annually for year one. In this post Ill explore the best 12 compound interest accounts so you can make more money and generate passive income from your money. Its still worth checking the fine print however because you dont want to get trapped in an investment that gives you less than you thought you.

Interest rates are as much as 10 times the national average with CIT Bank. Continuously compounding interest represents the mathematical limit that compound interest can reach within a specified period. Lucky for savers many banks offer savings accounts with interest that compounds daily or.

Treasury savings bonds pay out interest each year based on their interest rate and current value. Compare APYs and not interest rates. How Compound Interest Accounts Work.

Plus you can also program a daily compound interest calculator Excel formula for offline use. A basic savings account for example might compound interest daily weekly or monthly. While this may not seem like much once we increase the variable of the years of the 20000 compound interest investment we would see a balance of 98977 in 50 years compared to just 52500 with simple interest.

The interest rate is defined by r. If the given rate is compounded annually then. If interest is compounding daily that means that there are 365 periods per year and that the periodic interest rate is 00548.

The best way to compare interest rates earned on different money market accounts is to use an apples-to-apples approach.

Compound Interest Calculator With Formula

What Is Compound Interest And How Does It Work For Your Savings Ally

Compound Interest Definition Formula How It S Calculated

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Formula With Calculator

Daily Compound Interest Formula Step By Step Examples Calculation

Simple Vs Compound Interest Definitions And Calculators Quicken

What Is Compound Interest How To Calculate It

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Formula Step By Step Examples Calculation

Time Value Of Money Board Of Equalization

Daily Compound Interest Formula Step By Step Examples Calculation

Accounts That Earn Compounding Interest

Learn Daily Compound Interest Formula In Commercial Math

Compound Interest Formula In Excel And Google Sheets Automate Excel

Compound Interest Formulas Derivation Solved Examples

What Is Compound Interest And How Does It Work For Your Savings Ally

Komentar

Posting Komentar